33+ how to calculate nj property tax

Enter Any Address Now. Web New Jersey Property Taxes Go To Different State 657900 Avg.

2023 Summer Weeks Available Beach Haven Terrace Beach Haven Terrace Rental

Ad AARPs Calculator is Designed to Examine the Potential Return From an Investment Property.

. Your average tax rate is 1167 and your marginal tax rate is 22. Web See the 25 Highest Tax Homes in New Jersey here. Web Use the following formula to calculate an estimation of property tax for a new home in Hainesport.

Uncover In-Depth Assessment Information on Properties Nationwide. Web NJ Property Tax. Web If you make 70000 a year living in New Jersey you will be taxed 10489.

Web A towns general tax rate is calculated by dividing the total dollar amount it needs to raise to meet local budget expenses by the total assessed value of all its taxable. Web Use the amount of your 2021 property taxes as reported on your 2022 Property Tax Reimbursement Application Form PTR-1. Purchase Price x 8566 Estimated Assessment.

Learn How To File Your Taxes Alongside A Tax Expert When You File With TurboTax Live. Ad Skip The Tax Store And Have An Expert File Your Taxes From The Comfort Of Your Home. 4 beds 25 baths 33 Westminster Dr Par-troy Hills Township NJ 07054 679000 MLS 23004752 A world of space and expansion possibilities awaits.

This marginal tax rate means that. Web To calculate what you can claim on your taxes you would start by subtracting the amount of any insurance or other reimbursements from the total. For mobile home owners this is.

189 of home value Tax amount varies by county The median property tax in New Jersey is 657900 per. Industrial Property in Wayne taxes reduced from. Strip Mall on main road in Emerson taxes reduced by 19 per year.

Property Can Be an Excellent Investment. Web The average effective property tax rate is 226 which means that on average homeowners in New Jersey pay almost 250 of their home value in property. You were domiciled and maintained a primary residence as a homeowner or tenant in.

Calculate Understand Your Potential Returns. Web The RTF is calculated based on the amount of consideration recited in the deed or in certain instances the assessed valuation of the property conveyed divided by the. Ad Its Faster than Ever to Find Property Taxes Info.

Web You are eligible for a property tax deduction or a property tax credit only if. Web For Sale. Real property tax systems require owners of land and buildings to pay an amount of money to the state or local government based on the value of their land and.

1asiefke6wnkxm

Ocean Block 5 Bedrooms 4 Full Baths Sleeps 12

How Do I Look Up Property Taxes In Nj Youtube

Property Taxes In New Jersey To New Jersey Exp Realty

County Road Y County Road T Marshfield Wi 54449 Home For Sale Mls 22201330 Shorewest Realtors

Property Tax Rate Information For Towns In Middlesex County New Jersey

Suburban News West Edition August 19 2018 By Westside News Inc Issuu

Property Tax Rate Information For Towns In Middlesex County New Jersey

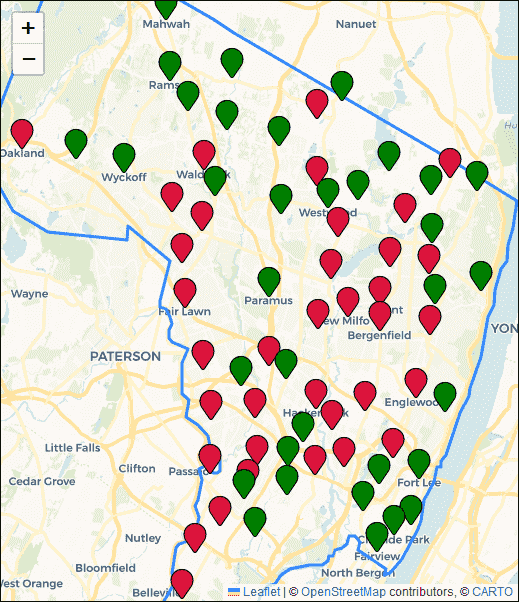

Bergen County Nj Property Property Tax Rates Average Tax Bills And Home Assessments

Large Surf City Home

Property Taxes In New Jersey To New Jersey Exp Realty

Are You Fairly Taxed Nj Targets Towns On Assessments

Beach Haven Ocean Block Central Ac Pet Friendly Fenced Yard Beach Haven Rental

Oceanside Charm Beach Haven Park Rental

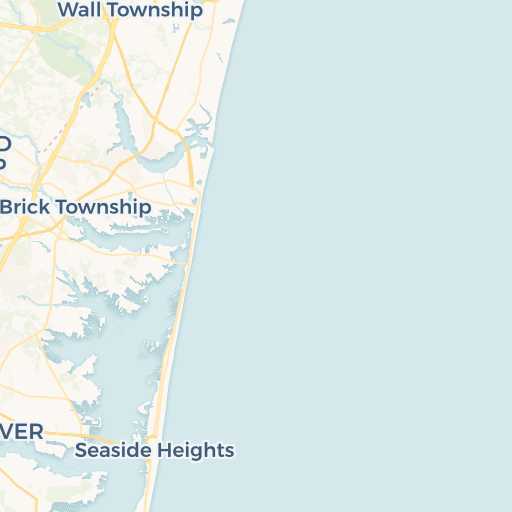

Solved Project 1 Property Tax Calculator Suppose A County Chegg Com

Ocean City Nj 3 Br 2 Ba Short Walk To The Beach 1st Fl Gold Coast Area

Bergen County Nj Property Property Tax Rates Average Tax Bills And Home Assessments