39+ Continuous compound interest calculator

To begin your calculation take your daily interest rate and add 1 to it. R nominal interest rate.

Expanding Compound Interest Equation To Find R Excel Formula Intrest Rate Compound Interest

A P 1 rnnt.

. Enter an initial balance figure. He who understands it earns it. Similar to how the charts above were calculated if we use a google sheet and enter FV 7 30 0 -10000 in a cell the calculation result will give us exactly 7612255 which represents.

In the formula A represents the final amount in the account. Compound interest is the eighth wonder of the world. Dividing both sides by e.

The amount after n years A n is equal to the initial amount A 0 times one plus the annual interest rate r divided by the number of compounding periods in a. This Compounding Calculator shows you how the interest you earn each year is added to your principal so that the balance doesnt merely grow it grows at an. We started with 10000 and ended up with a little more than 500 in interest after 10 years in an account with a 050 annual yield.

The compound interest of the second year is calculated based on the balance of 110 instead of the principal of 100. 100000 50000 27183r 8 Dividing both sides by 50000 we get. But by depositing an additional 100 each.

P value after t time units. Range of interest rates above and below the rate set above that you desire to. Thus the interest of the second year would come out to.

Use this free continuous compound interest calculator. Enter a percentage interest rate - either yearly monthly weekly or daily. This can be shown as 1000 times e2 which will return a balance of 122140 after the.

The continuous compounding calculation formula is as follows. To calculate the ending balance after 2 years with continuous compounding the equation would be. PV present value.

You may find out the difference easily. FV PV e rt. Enter a number of years or months or a combination of both for the calculation.

Interest rate variance range. The following is a basic example of how interest works. Using the above formula you can calculate the future value.

N compounding frequency. Next raise that figure to the power of the number of days it will be compounded for. Plugging those values into the formula and solving for r we get.

R interest rate. Its because the rate of interest may not increase by. There are two distinct methods of accumulating interest categorized into simple interest or compound interest.

110 10 1. FV future value. The compound interest formula solves for the future value of your investment A.

Your estimated annual interest rate. P the principal the amount of. The compound interest formula is.

T number of time periods. To calculate continuously compounded interest use the formula below. Continuous compound interest is slightly different from the simple interest one.

Should I Buy If The Open Interest Value Is High In Options Quora

The Sample Variance Explanation Examples

How To Calculate Interest Compounding For Exponential Growth Accounting Principles Money Quotes Business Savvy

Suppose That 12 000 Is Invested In A Savings Account Paying 5 6 Interest Per Year How Long Will It Take For The Amount In The Account To Grow To 20 000 If Interest Is

Someone S Trash Is Our Treasure

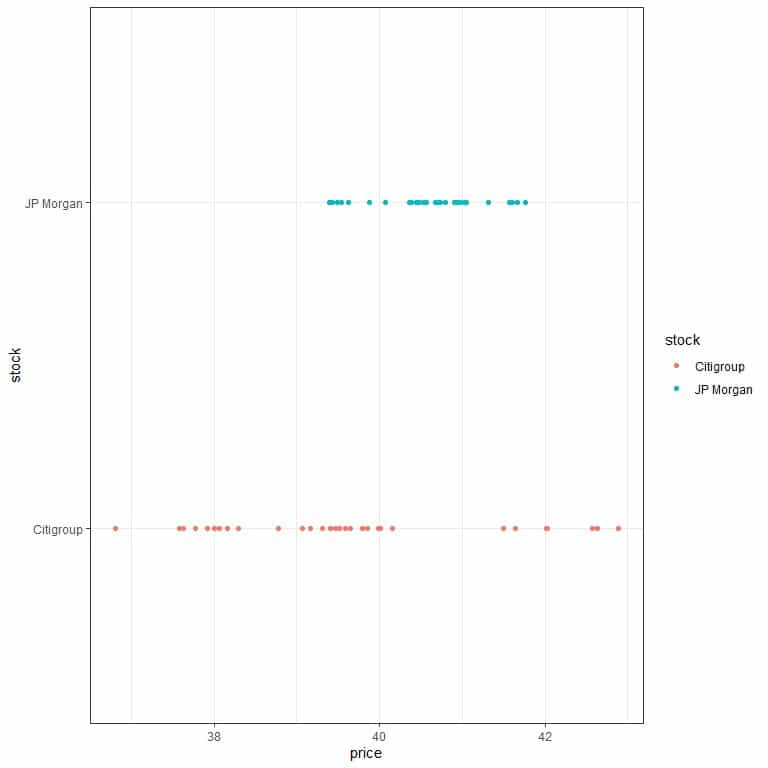

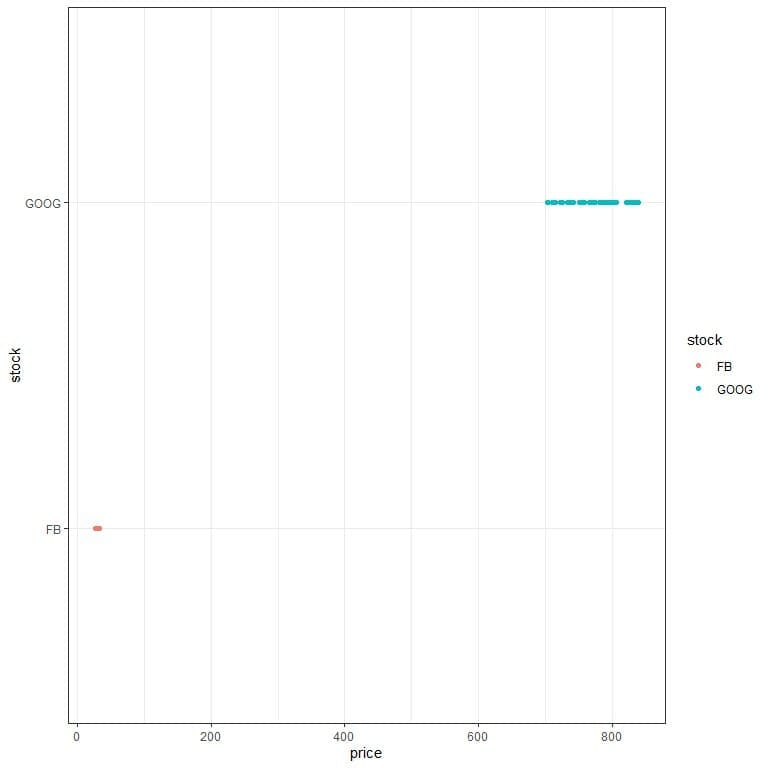

What Is Your Opinion About Ongc Shares Quora

Continuous Growth Exponential Word Problem Worksheets Exponential Growth

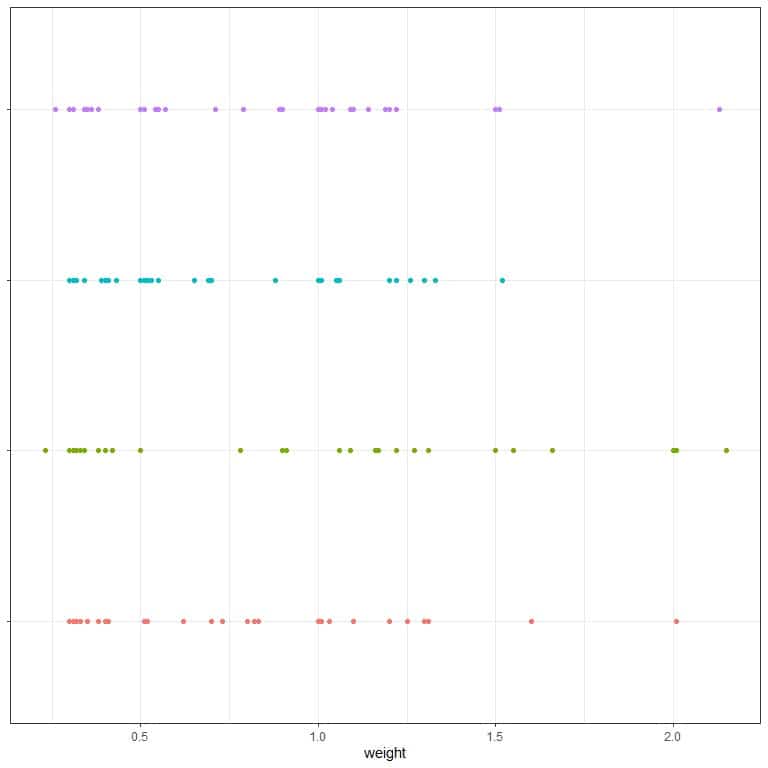

The Sample Variance Explanation Examples

The Sample Variance Explanation Examples

Should I Buy If The Open Interest Value Is High In Options Quora

Why Is Patience Important In Investing Quora

Continuous Growth Exponential Word Problem Worksheets Exponential Growth

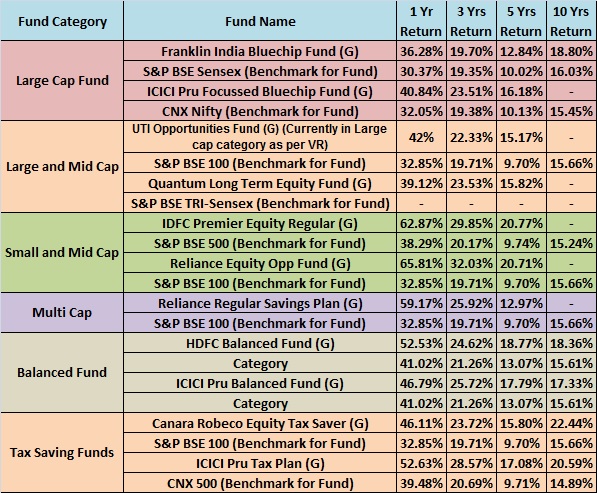

Top 10 Best Mutual Funds To Invest In India For 2015

Suppose That 12 000 Is Invested In A Savings Account Paying 5 6 Interest Per Year How Long Will It Take For The Amount In The Account To Grow To 20 000 If Interest Is

Effective Interest Rate Formula Interest Rates Accounting And Finance Rate

My New Favorite Calculus App Calculus Ap Calculus Ap Calculus Ab

The Sample Variance Explanation Examples